- INTRODUCTION

Private Companies are most popular form of entities preferred to be formed for carrying on business as there are various exemptions available to Private Limited Company and there are comparatively lesser Compliances involved when compared with Public Companies.

Benefits of forming Private Limited Companies: –

- No Minimum Capital;

- More Credibility;

- Limited Liability;

- Easy Exit and transferability;

- Start-up Recognition;

- Benefits in getting Loans from Banks/ Financial Institutions;

- Tax Benefits; etc.

Definition of Private Company: –

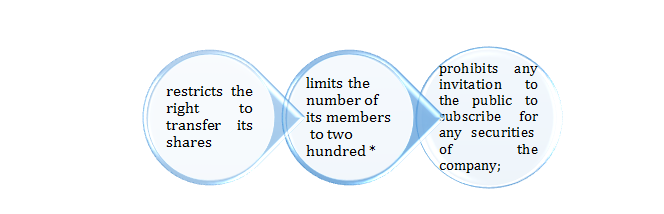

Section 2 (68) of Companies Act, 2013: –

A Private Company means a Company which by its articles,—

- *Provided that where two or more persons hold one or more shares in a company jointly, they shall, for the purposes of this clause, be treated as a single member:

Provided further that—

(A) persons who are in the employment of the company; and

(B) persons who, having been formerly in the employment of the company, were members of the company while in that employment and have continued to be members after the employment ceased,

shall not be included in the number of members

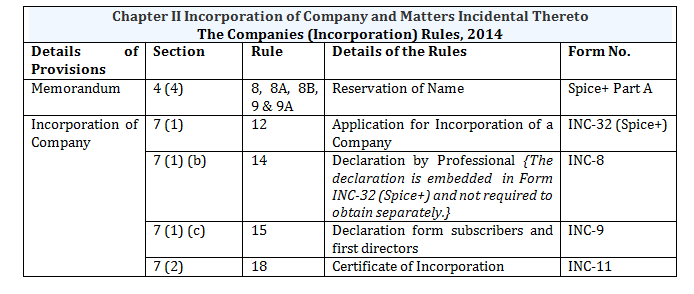

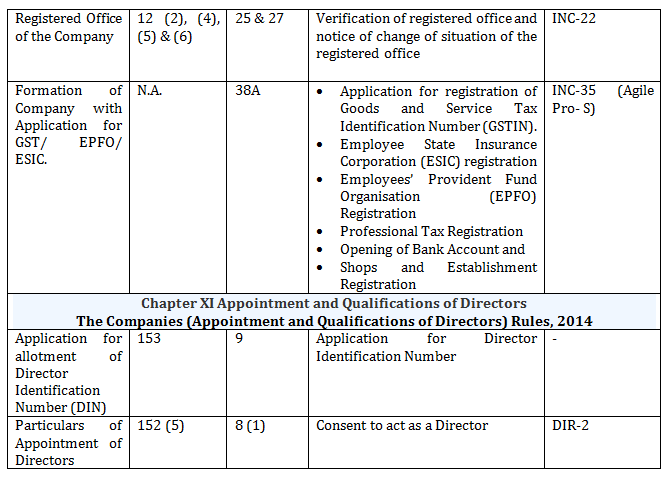

- GOVERNING LAWS:

- CHECKPOINTS

- Minimum Number of Directors: 2

- Maximum Number of Directors: Details of which can be filled in, in the incorporation forms

| Not Having DIN | Having DIN | Total Number of Directors allowed (Including Having DIN and not having DIN) |

| Maximum 3 as Form Spice + enables the details to be filled in only for upto 3 directorsIn case, the number of Directors to be appointed is more than 3, they are to be appointed after the Incorporation of the Company | Maximum 20 | Maximum 20 |

- Minimum Number of Members: 2

- Digital Signature Certificate (DSC): Obtain a DSC from the authorised DSC issuing authority for: Applicant & Subscribers

- SERVICES OFFERED IN SPICE+

- Incorporation

- DIN Allotment for upto three applicants

- PAN (Mandatory)

- TAN (Mandatory)

- EPFO Registration (Mandatory)

- ESIC Registration (Mandatory)

- Professional Tax Registration (Mandatory only for Companies to be registered in Maharashtra, Karnataka and West Bengal)

- Opening of Bank Account for the Company (Mandatory)

- Allotment of GSTIN (Optional, if applied for)

- Allotment of Shops and Establishment Registration Number (only for Delhi Location)

- PROCEDURAL ASPECTS & COMPLIANCE CHECKLIST

Spice+ is the online Web based Form which is to be filled post login the option for the same is available under MCA Services Tab;

| Step 1: Application for Reservation of Name Spice+ Part – A :- | Details to be filled in Spice+ Part- A for Name Reservation: Type of Company- New Company (Others)Class of Company- Private CompanyCategory- Company Limited by sharesSub- Category- Non- Government CompanyMain Division of Industrial Activity Code- Appropriate code must be entered depending upon the business activity proposed to be carried on by the CompanyDetails of Proposed Name to be entered (Two names can be applied in order of preference)Details w.r.t. Summary of Objects proposed to be carried on by the Company Attachments (if applicable):- In case if the proposed name contains the trademark then No Objection Certificate for use of such name obtained from owner of the trademark or applicant of such application of registration of trademark along with KYC documents of the applicant/ owner of registered trademark.A Certified True copy of No Objection certificate by way of board resolution / resolution in case the name is similar to any existing Company.Such other documents as may be relevant depending upon case to case. Note: Spice+ Part A can be submitted separately for name reservation or it can also be submitted along with Spice+ Part B |

| Step 2: Application for Incorporation Form INC-32 Spice+ Part B | Details | ||

| Details w.r.t Proposed Company | |||

| Capital Structure of the Company | Details w.r.t Authorised Share Capital and Subscribed Share Capital as follows: Type of Shares – Equity; Preference; UnclassifiedNumber of SharesNominal Amount per share (in Rupees)Total Amount (in Rupees) | ||

| B.) Registered Office of the Company | If the address for correspondence is the address of registered office of the Company, then following attachments are mandatory:Proof of Office Address of the registered office (Conveyance / Lease deed/ Rent Agreement etc. along with rent receipts)Copy of utility bills (not older than 2 months) If the registered office address and the correspondence address are different, then an option is available to inform the correspondence address at the time of incorporation in Spice + Part B. In this case, file Form INC-22 for intimating the situation of registered office of the Company within 30 days from the date of Incorporation * The Company shall maintain within 30 days of incorporation and all times thereafter, its registered office capable of receiving and acknowledging all communications. Contact Details of Proposed Company i.e. Contact Number and Email ID Selection of appropriate ROC Office depending upon location of Registered Office of the Company | ||

| Details w.r.t Subscribers and Directors | |||

| Fill in necessary personal details of Subscribers and First Directors: – Documents Required w.r.t Subscribers and First Directors not having DIN: Proof of Identity: Voters Identity Card/ Passport/ Driving License. Proof of Address: Bank / Electricity Bill/ Telephone bill/ Mobile bill. PAN Card is mandatory Other Documents Required w.r.t First Directors: Form DIR-2 (Consent to act as director)Annexure for Disclosure in other entities to be attached to INC-32 (Spice+) in case the person getting appointed as a director is interested in more than one entity | |||

| Details w.r.t PAN TAN Codes | |||

| Check the following details based on the Registered Office of the Company: Area CodeAO TypeRange CodeAO TypeSource of Income | |||

| LINKED FORMS | |||

| Spice + MOA (INC-33) | Following Details are required to be filled: – Main Objects to be pursued by the Company on its Incorporation;Ancillary Objects; Authorised Share Capital of the Company;Details w.r.t Subscribers and Number of shares subscribed by the Subscribers;Details w.r.t Witness | ||

| Spice+ AOA (INC-34) | Table F- of Schedule 1 of Companies Act, 2013 is applicable in case of Company Limited by shares. e-AOA (INC-33) has facility for adding, modifying, and deleting Articles. | ||

| Agile Pro- S | Details: Primary Business Activity;Authorized directors’ details in case of opening provident fund account for instance name, father’s name, contact no., e-mail id, passport size jpg image;Whether the registered office is taken on lease or not? If yes, period of the lease.Whether the proposed company intends to apply GST?OTPs for verification of two authorized signatories whose details will be entered in the form.Identity proofs of authorized persons e.g., self-attested PAN card.Permanent and present residential proofs of authorized persons i.e., self-attested Aadhar card and bank statement/electricity bill/mobile bill/telephone bill, etc. not older than two months respectively.Specimen signature card to be duly signed by the authorized persons for registration with Employees’ Provident Fund Organization.Name of bank account in which the proposed company will open its current account. Attachments for AGILE-PRO-S (E-FORM INC-35) PAN of authorized persons as identity proofs. Aadhar of authorized persons as residential proof Latest bank statement/electricity bill/telephone bill/mobile bill (not older than two months) Specimen Signature Card for registration with EPFO. Passport Size Photographs | ||

| INC-9 | INC-9 is auto- generated and is required to be submitted in electronic form except in following cases: – Total number of subscribers and/ or directors is greater than 20 and/orAny such subscriber/ director has neither DIN/ PAN | ||

After filling all the necessary details online download the E-Forms by clicking the download icon available at the side of E-Forms and affix Digital Signatures and the same can be uploaded like Normal Forms along with payment of prescribed registration fee and fee of forms as per the Companies (Registration and Fees), Rules 2014, as are required to be paid.

- FAQ’s

Q.1. What is the sequence of uploading Linked E-Forms to Spice+ in relation to Incorporation of Private Limited Company?

- The sequence of uploading linked E-Forms to Spice+ is as follows:

- Spice+

- E-MOA (if applicable)

- E-AOA (if applicable)

- Agile Pro- S

- INC-9 (if applicable)

Q.2. How can I extend the name reserved through Spice+ Part A and what is Government Fees for the same?

- As per Rule 9A of Companies Incorporation Rules 2014 an applicant can apply for extension of name reservation only before expiry of name reservation period by clicking on ‘Extend’ button that is enable against the ‘Approved’ Spice + Part A SRN after choosing the required period of extension and making the requisite payment.

Fees payable for extension of name reservation is as follows:

- 20 to 40 days – Rs. 1000/-

- 20 to 60 days – Rs. 3000/-

- 40 to 60 days – Rs. 2000/-

Q.3. How many times modifications/ changes can be made to Spice+ after generating PDF and affixing DSC’s can be made?

- Modifications/ Changes to SPICe+ after generating pdf and affixing DSC’s, can be made up to five times by editing the same web form application which has been saved, generating the updated PDF affixing DSCs and uploading the same.

Q.4. Under which role DSC needs to be associated for Subscribers or First Directors not having DIN?

- Subscribers/ First Directors not having DIN shall associate their DSC under ‘Authorised Representative Category’ by providing their PAN. Once DIN is associated to first Directors post approval of Spice+, DSC may be updated against DIN by using ‘Update DSC Service’

As per MCA V3 for registering DSC User registration is mandatory since DSC Association is a post login service now. Multiple DSC association cannot be done using one user ID.

Q.5 Is it mandatory to use E-MOA (INC-33) and E-AOA (INC-34) with Spice+?

- Yes, it is mandatory to use E-MOA (INC-33) and E-AOA (INC-34) in case the number of subscribers are upto Seven and in following scenarios:-

- Individual subscribers are Indian Nationals;

- Non- Individual subscribers based in India;

- Individual Subscribers who are foreign nationals and having valid DIN and DSC and they also submit a proof of valid Business VISA.

- ROLE OF COMPLIANCE CALENDAR LLP

Private Company is most suitable and convenient form of business which is recognized globally. Drafting of Chartered documents of the Company i.e. Memorandum of Association and Articles of Association, and other documents required for Incorporation requires knowledge of provisions of Company Law and also the Forms relating to Incorporation needs to be Certified by Practicing Professionals. Compliance Calendar LLP Online Company Registration has a team of skilled legal professionals who can provide you proper assistance and guidance for formation of Private Limited Company. If you have any questions, you are welcome to email us at info@ccoffice.in or connect at 9988424211