Startup India is a flagship initiative of the Government of India which was launched on January 16, 2016. The Startup India Initiative has launched several programs with the aim of supporting entrepreneurs, building a strong startup ecosystem and transforming India into a country of job seekers rather than job seekers. These programs are managed by a dedicated Startup India team, which reports to the Department of Industrial Policy and Promotion (DPIIT).

In this initiative to support startups in all aspects, the government has given several benefits under various laws such as exemption under Income Tax Act, fast track process of IPR and exemption for filing it, self-employment for 9 labor and environment laws for period of 3 years, easy finance availability, exemption from EMD in government contracts and easy exit system under Stand Up India scheme.

Under the Startup India Action Plan, startups that fulfill the definition prescribed under G.S.R. notification 127(e) are eligible to apply for recognition under of the program. Startups are required to provide supporting documents at the time of application.

Eligibility Criteria for Startup Recognition:

- The startup must be incorporated as a private limited company (PLC) or registered as a partnership firm or a limited liability partnership (LLP).

- The turnover in any previous financial year should be less than INR 100 Crores.

- An entity shall be treated as a Startup for 10 years from the date of its incorporation.

- Startups should work towards innovation/improvement of existing products, services and processes and should have the potential to generate employment/wealth. An entity formed by the divestment or reconstruction of an existing business shall not be considered a “startup”.

Startup Recognition Procedure

The procedure for recognition of an eligible entity as a Startup would be as under:-

(i) The startup will apply online on the mobile app or portal set up by DPIIT.

(ii) The application will be accompanied by-

(a) a copy of the certificate of incorporation or registration, as the case may be, and

(b) a write-up about the nature of the business showing how it is working towards innovation, development or improvement of products or processes or services, or its scalability in terms of job creation or wealth creation.

(iii) The DPIIT may, after calling for such documents or information and making such inquiries as it may deem fit,-

(a) Identifying the eligible entity as a Startup; or

(b) reject the application by providing genuine reasons.

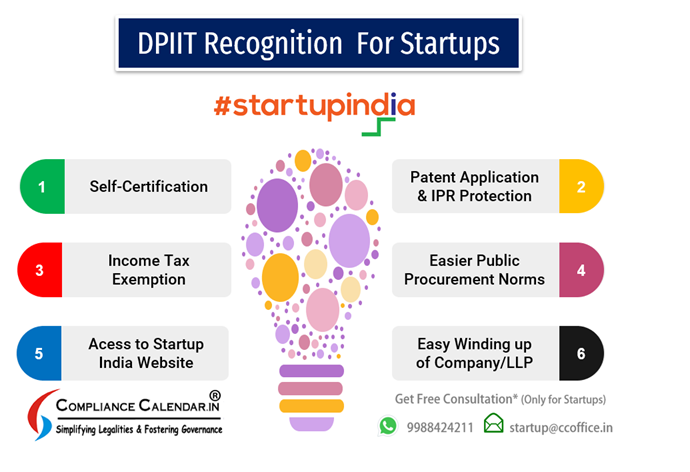

Let us look at the benefits that DPIIT recognition will provide to startups.

80-IAC exemption under the Income Tax Act:

Once recognized, a startup can apply for tax exemption under section 80 IAC of the Income Tax Act. Once cleared for tax exemption, the startup can avail tax holiday for 3 consecutive financial years out of its first ten years since incorporation.

Eligibility Criteria to Apply for Income Tax Exemption (80 IAC):

- The entity should be a recognized Startup.

- Only Private Limited or Limited Liability Partnership is eligible for tax exemption under section 80IAC.

- Startups should have been incorporated after April 1, 2016 but before April 1, 2021.

- The aggregate turnover of its business does not exceed twenty five crore rupees in the previous year relating to the assessment year for which the deduction is claimed, and

- It holds a certificate of eligible occupation from the Inter-Ministerial Board of Certification notified by the Central Government in the Official Gazette.

After getting cleared for tax exemption, the startup can avail 100% tax deduction from the profits and gains derived from the eligible business for 3 consecutive financial years out of its first seven years since incorporation.

“Eligible Business” means a business carried on by an eligible start-up that is engaged in innovation, development or improvement of products or processes or services or a scalable business model with high potential for job creation or wealth creation;

Tax Exemption under Section 56 of the Income Tax Act for Startups

Once recognized, Startup can apply for Angel tax exemption.

Eligibility Criteria to apply for Tax Exemption under Section 56 of the Income Tax Act:

- The entity of this exemption should be a DPIIT recognized Startup.

- The aggregate amount of the paid-up share capital and share premium, if any, of the startup after the proposed issue of shares does not exceed INR 25 crores.

Effective regulatory compliance

There are issues related to maintaining many regulatory requirements under various laws like labor laws, environment laws which are time consuming where new and small businesses lack a lot of expertise to comply with such regulatory issues. For startups, it is essential to engage in simplified procedures for a conducive environment. With such recognition, startups will be able to self-certify themselves to labor and environmental laws. There will be no inspection for three years; Nevertheless, inspections can be carried out on credible reports of violations approved by a level senior to the inspecting officer. Startups can self-certify compliance with respect to the following:

Labour Laws:

Payment of Gratuity Act, 1972

Employees Provident Fund and Miscellaneous Provisions Act, 1952

Employees State Insurance Act, 1948;etc.

Environment Laws:

The Water (Prevention & Control of Pollution) Act, 1974, Air (Prevention and Control of Pollution) Act, 1981, The Water (Prevention and Control of Pollution) Cess (Amendment) Act, 2003.

Easy exit

There is a possibility that the startup may fail, which is also important to provide a simple process for closing the business. In case of failure the startup can easily withdraw the resources that they have invested. This is important because such a quick and simple process can help startups to invest elsewhere. There are some issues with startups where, in case of failure, they get stuck in a long exit process. The Insolvency and Bankruptcy Code 2016 provides a simple process for startup winding up with a simple loan structure. Those fulfilling certain conditions can be closed within 90 days of filing the application for fast track winding up.

Public Procurement

For public procurement, the government excludes startups from the previous experience criteria. This will help startups to procure easily in government tenders. Still, startups need to show that they have the capabilities and have manufacturing facilities in India.

Also, in case of fund allocation, startups will be eligible for funding from alternative investment funds. In addition, they can also avail a credit guarantee of INR 2000 Crores through National Credit Guarantee Trust Company or SIDBI in 4 years.

Conclusion:

Government of India has launched Startup India scheme with abundant benefits under various laws out of which we have explained the benefits of 100% tax exemption for 3 years and capital gains tax under section 56(2)(vii b). These benefits are meant to support the new innovative and small startups in the early years of the struggle which will not be given in case of restructuring the existing business. The main objective is to inspire young entrepreneurs who can also generate employment for others in the country. The government is also exempting capital gains tax on additional issuance of shares over fair value but the return received should not be invested in non-business activities. If you have any questions, feel free to email us at info@ccoffice.in or connect at 9988424211